Best Travel Insurance

Based on In-Depth Reviews

- 200+Hours of research

- 60+Sources used

- 15Companies vetted

- 3Research Criteria

- 6Top

Picks

- COVID-19 is not a listed reason for travel insurance policies

- Look for customizable coverage

- Get a comprehensive policy for once-in-a-lifetime trips

- Estimate how much travel insurance you need in advance

How we analyzed the best Travel Insurance Companies

Our Top Picks: Travel Insurance Reviews

Travel Insurance and the Novel Coronavirus

In light of the current Covid-19 pandemic—and the accompanying social distancing and travel restriction measures implemented across the world—record numbers of flights, vacations, cruises, and other travel plans have been thrown into disarray. While the response from individual airlines and hotel chains has been to relax their cancellation policies, travel insurance companies are a different story. The travel insurance policy types that would apply to most of those canceled plans are trip cancellation or trip interruption, both of which are usually named-peril plans. This means that they'll honor the coverage on the insurance policy, but ONLY IF the reason for cancellation is listed in the plan. And neither the fear of contracting coronavirus or the fact that there is a very real worldwide pandemic, are listed reasons.

There is one notable, albeit more expensive option, if you purchase (or purchased) a Cancel For Any Reason (CFAR) add-on policy, then you can do exactly that: change your travel plans entirely and practice social distancing at home. To qualify, you must have purchased the CFAR within the insurer's specified timeframe after making your first payment, and you must insure the totality of your trip costs. You should also know that even a CFAR only goes so far—you won't be fully reimbursed, even though you're insuring 100 percent of your costs—most travel insurance policies give you the option of a 50 or 75 percent reimbursement.

Given the situation, before booking any travel and purchasing travel insurance, we recommend that you follow the current Center for Disease Control (CDC) recommendations. Ask yourself:

1. Are coronavirus cases surging or spreading at your destination?

2. Do you live with someone who at high risk of infection from the coronavirus?

3. Likewise, are you yourself at high risk of becoming gravely ill from coronavirus?

4. And finally, does your destination have any travel restrictions or requirements?

This fourth question is key since it can significantly derail your plans—many state, local, and territorial governments have implemented restrictions of varying degrees, from mandatory testing or quarantines to outright travel bans. The European Union, for instance, just extended its travel ban for U.S. citizens, while Ireland and Hawaii allow travel but require a two-week, in-country quarantine. In short, we recommend you take the time to verify if this is the case in your chosen destination, either on state or local public health websites if traveling within the continental U.S., or through the U.S. Department of State's Country Information page.

Best for Travel Insurance Options

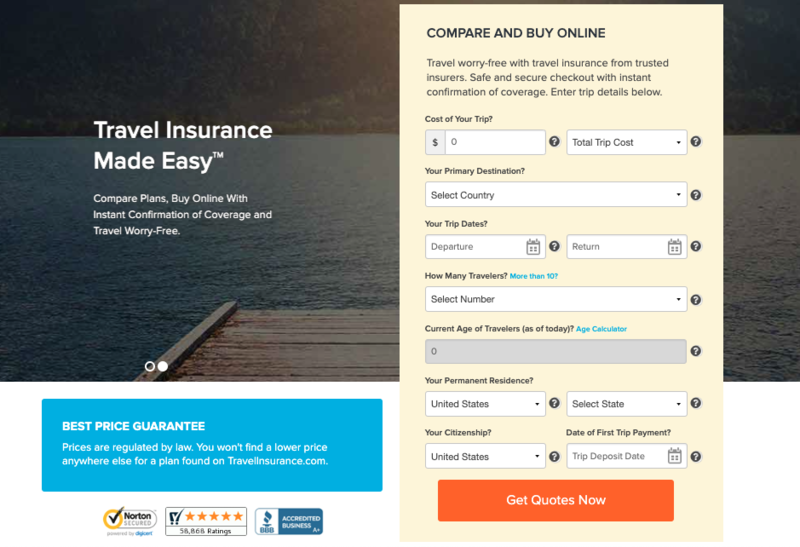

For consumers who want comparison shopping convenience, TravelInsurance.com is a great choice since it allows you to compare many policies at the same time.

Screenshot ravelinsurance.com, December 2019.

Customers are asked to fill in a simple web form that asks for the dates, destination, and total cost of an upcoming trip. The website instantly generates a list of available policies (26 of them for a hypothetical trip we described), their coverages, their costs, and their issuers’ financial strength ratings. The information is laid out on a single page in an easy-to-read format. Prospective travelers can do side-by-side comparisons of a smaller number of policies.

TravelInsurance.com is not an insurer itself, but it partners with many of the insurers we recommend. Before purchasing any one travel insurance policy, it's a good idea to research the company issuing it to gather even more information about it.

Best for the Young and the Restless

World Nomads offers a choice of two plans. The primary difference between the two, aprt from cost, of course, are the benefit limits associated with each. Both plans offer the same types of coverage, including trip cancellation, trip interruption, emergency medical, evacuation, repatriation, and personal property losses. We used a hypothetical $3,000 trip to France tWorld Nomads' policies to competitive plans.

World Nomad's Standard Plan has a benefit limit of $2500. It wouldn't cover the entire cost of our hypothetical trip to France, but it would certainly lessen the economic blow of cancellation or interruption. World Nomad's Explorer Plan has a benefit limit $10,000 for cancellation and interruption. It would fully reimburse the cost of our hypothetical trip. I's important to understand that you can't collect any more than your trip cost with trip cancellation or interruption coverage, no matter how high the benefit limit of your policy. Our hypothetical traveler would want to compare the premium difference between the two plans. If it were more than $500, then World Nomad's Explorer plan would probably not make good financial sense.

Both of World Nomad's plans reimburse travelers for up to $100,000 in travel medical expenses. The Standard Plan covers up to $300,000 in medical evacuation costs while the Explorer Plan ups that figure to $500,000. The Standar plan offers up to $1000 reimbursement for baggage loss or theft, while the Explorer plan protects you for up $3000 for those losses. The more expensive of World Nomad's plans might make sense if you carry a lot of expensive gear when you travel, but again, travelers must weigh the cost of increased coverage against the benefits.

Unlike many travel insurance providers, World Nomads covers a large number of sports in its Standard Plan (kite surfing, ice hockey, and that most dangerous of sports… air guitar) and more extreme sports under the Explorer Plan (bull riding, cave diving up to 165 feet/ 50 meters, and mixed martial arts), making it a great choice for the adrenaline junkies. The full list of covered activities is well worth a read if only for entertainment purposes. Now that we know what ski joring is, we're raring to try it ourselves!

Screen shot of worldnomads.com, July 18, 2019.

Great Guides and Community

What truly differentiates World Nomads from a crowded field is the sense of community it cultivates with its customers. The website contains free travel guides to numerous worldwide destinations, as well as free downloadable educational material on travel writing, filmmaking and other topics.

There are also sections dedicated to fascinating true travel stories to inspire your next trip, and entertaining and bizarre testimonials from World Nomads insurance customers. We’ll warn you, some of these tales are not for the faint of heart.

In keeping with the community theme, World Nomads presents an option at checkout to donate a few dollars to one of three charities, including a program dedicated to sight-restoring surgery in Kenya. According to the website, 85% of World Nomads customers elect to donate.

World Nomad's Disclaimer

All of the information provided about travel insurance is a brief summary only. It does not include all terms, conditions, limitations, exclusions and termination provisions of the travel insurance plans described. Coverage may not be available for residents of all countries, states or provinces. Please carefully read your policy wording for a full description of coverage.

Best for the Vip Traveller

Strictly speaking, Medjet doesn’t provide travel insurance in the classic sense. For instance, there are no coverage options for trip cancellation, loss or delay of baggage, or many other standard travel medical insurance features. For those, you’ll have to purchase a standard travel insurance policy from another provider.

Medjet offers industry-leading global medical evacuation services to both private and corporate clients. With a network of hundreds of air ambulances and medical escorts located around the world, if you are hospitalized, Medjet provides transport to the home-country hospital of your choice aboard aircraft outfitted with state-of-the-art emergency medical equipment. Travel insurance typically requires you be treated and recover in the “nearest acceptable facility”, Medjet allows you get to a hospital at home.

Medjet operates on a membership model, with a number of programs calibrated to fit the needs of different types of travellers. Short term memberships for trips as short as 8 days are available, as are programs for students and professors and longer-term expatriates.

While there is no medical transport cost limit as long as your membership is current, Medjet does cap evacuations to two per member per year, or one for a member family. Though if you’re in need of more than two evacuations per year, you may want to reconsider your life choices.

Screen shot of medjetassist.com, July 18, 2019

Customers up to 75 years old can be covered under any of Medjet’s policies. Beyond that is a senior-specific Diamond membership which covers customers between the ages of 75 and 84.

In addition to medical evacuation, MedjetHorizon--the premium-tier option--provides professional crisis response assistance for victims of terrorism, natural disasters, kidnapping, hijacking, political threats, blackmail, and other events. If you are at risk for such hair-raising predicaments, standard travel insurance simply won’t suffice. These options are intended for VIP travellers such as high level corporate executives or high profile individuals--think C-suite execs and movie stars— but it’s also ideal for anyone who travels alone.

BEST FOR TRIP CANCELLATIONS AND INTERNATIONAL SUPPORT

Generali provides great value for your buck. Generali’s 24/7, year round “Telemedicine" service connects you with a network of American doctors for non-emergency medical consultations, advice, and prescriptions. The Premium plan offers a million dollars in medevac coverage, and nice extras, like $500 for sports equipment delays and $1,000 for missed connections. This policy is perfectly suited for the well-to-do traveler with a lot of money invested in a trip.

Generali scored high with us because, as travel insurers go, they offer some of the most comprehensive coverages, highest payout maximums, and many additional policy features other providers don't. All standard trip interruption and cancelation reasons are provided for, and then some. Additionally, the company has generous provisions for baggage and trip delays. Generali really shines when it comes to its traveler assistance services. Along with all the usual customer assistance features, the company also makes provision for such things as specialty food delivery, an emergency cash advance of $500, and travel companion meet and greet services. Pound for pound, one of the most extensive offerings out there.

The company will cover up to a whopping $250,000 max for medical care, and up to $1 million for emergency medical transportation. There are three plan levels that, aside from a few items, only differ in maximum payouts for certain coverages.

Generali also stands out in the trip interruption/cancellation category. They will reimburse up to 175% the cost of the trip due to trip interruption, and also provide a generous $1,000 travel delay reimbursement. If you purchase the premium plan, the coverage kicks in after a mere 6-hour delay.

Generali, unique among travel insurers, also provides trip cancelation coverage in the event of sickness/death of a service animal. In addition to all the standard trip cancellation reasons, the company also includes coverage if you are unable to get a vaccination necessary for travel, and coverage if you have to cancel due to notification of a successful organ match.

Generali boasts many more customer assistance services than standard among travel insurance providers. These include identity theft resolution services, personalized retail shopping assistance services, procurement of hard-to-find items, limousine pick up of friends and business partners, pre-trip assistance, specialty food delivery, and booking golf tee times just to name a few. Generali's 24-hour emergency hotline can be accessed from anywhere in the world and includes medical, travel, and concierge assistance services.

The company's services are accessible anywhere in the world and they maintain a BBB accreditation of A+. Generali Global Assistance operates as a subsidiary of Europe Assistance Holding S.A. and their travel insurance business evolved from CSA Travel Protection.

Best for the Travelers on a Larger Budget

While a quick glance at AXA’s rather generic website might suggest that there’s nothing special about the company, the true value of its policies becomes apparent when you look at what’s covered. The Platinum plan for our $3,000 trip costs a quoted $125 and includes a remarkable suite of coverages. With medical expenses capped at $250,000 and medevac and repatriation capped at a cool million, the plan truly lives up to its precious metal namesake.

Screen shot of axatravelinsurance.com, July 18, 2019.

Trip cancellation and interruption pay out at an industry-standard 100% and 150% respectively, and baggage protection is well within the normal range as well. But the Platinum plan really shines when it comes to the little touches, such as a $25 a day (max of 5 days) pet boarding benefit for trip delays, $1,000 sports equipment rental, and $500 to lost golf rounds or skiing days. That’s a lot of value for 4.17% the price of our overall trip.

Identity theft protection, concierge services, a mobile app, and a blog featuring articles about various travel and travel-adjacent topics round out an above average policy. If you want high level, comprehensive coverage that won’t break the bank, AXA Platinum is a great option.

Faye is a travel insurance startup founded in 2019. The company offers domestic and international whole-trip travel insurance and provides comprehensive coverage for travelers. Some of the things covered by Faye’s travel insurance packages include baggage loss, trip cancellation and medical coverage.

The company helps the insured with most of a traveler’s usual woes when visiting another country, including unexpected cancellations and delays, natural disasters and even political turmoil. In light of the coronavirus pandemic, Faye also covers non-refundable medical and trip delay expenses if you become ill with COVID-19. Coverage includes emergency medical expenses, accomodation for quarantine and extension costs.

You can submit a claim through the company’s app or through email in an entirely digital process. Faye’s plans are underwritten by the United States Fire Insurance Company, which is rated A by the A.M. Best of 2021. The company’s non-insurance assistance is provided by Global Excel Management Inc., which deals with everything from 24/7 travel assistance to real-time flight alerts.

Pricing varies by the level of coverage, with insurance from its basic plan traveling to Europe for one customer for one week coming out to $135. Faye has a 4.6 rating on Trustpilot, with the majority of reviews rating the company “excellent”. The company is not yet rated on the Better Business Bureau’s website.

Faye offers assistance 24/7 365 days a year, connecting you with real humans when you run into a problem in the middle of a trip. Faye can also be reached through email at support@withfaye.com. All in all, Faye’s commitment to being there for travelers as well as its comprehensive coverage provided by an underwriter with a strong reputation make it easy to recommend.

Other Great Providers

Allianz Travel

Allianz is the largest insurance provider in the world, which in itself doesn’t mean that much. However, with that size comes a great deal of experience and an extremely diverse portfolio of policies including annual plans covering multiple trips, family plans, and policies that cover extended trips up to a year long. These specialized offerings are perfect for families traveling together or temporarily moving to another country.

Amex Travel

Long associated with international travel, American Express’s travel insurance wing provides four tiers of protection, from a bare-bones policy to comprehensive coverage. In addition, you can create your own policy, where you pick and choose your preferred areas of coverage. In a rare move, the website also provides a sample policy contract to read before you buy. This flexibility will appeal to travelers who know what coverage they need and don’t want to waste money on coverage they don’t.

Travelex

An old standby and originally an arm of Mutual of Omaha, Travelex remains a popular choice for travel insurance. Travelex offers two levels of standard protection and a number of policy add-ons to build just the right insurance for your trip. A bit on the pricey side, the costs are more than offset by top-flight concierge services and decades of experience in the industry. With above average costumer comments, Travelex is a solid choice for anyone thinking of going on a trip.

More insight into our methodology

We wish we could tell you that we went about researching this article by buying travel insurance ourselves and jetting off to the Maldives or Bora Bora to try it out. Unfortunately our killjoy editor quickly quashed that idea. [Note from killjoy editor: Your request for paid time off is denied. See me.] Instead we had to do this the old-fashioned way with a lot of legwork, research, and interviews. We even read an entire ten page travel insurance policy cover to cover. A page turner it was not.

When we started this article, we thought we’d spend a lot of time talking about loopholes, shady insurance providers, and tips on how to wring the money you deserve out of tight-fisted companies. Imagine our surprise to discover an industry that largely delivers on coverage promises and pays out a high percent of claims. Though the industry is not perfect, and many customer complaints are completely valid, we discovered that when the right steps are taken, travel insurance really can save your trip, your bank account, and even your life. And isn’t your peace of mind worth the average travel insurance policy price of 4-10% of the cost of your trip?

A recent survey of the British insurance industry claimed a travel insurance payout rate of 87%. Comparable, but by no means definitive rates are cited in America, where the industry is more protective of its data.

The trick, as with all insurance, is to always know what you’re buying. Sounds simple, right? Take it from a team that actually read a policy and we can assure you, it is not. But don’t panic: once you know what to look for and how to read one of these contracts, you can rest easy knowing exactly where your coverage begins and where it ends.

In order to find out how to do that, we talked to people on both sides of the travel insurance market. Megan Cruz is the Executive Director of the US Travel Insurance Association. The UStiA is a trade association whose mission is “to foster ethical and professional standards of industry conduct, cultivate effective state and federal government relations, inform and assist members, and educate consumers.” The organization serves as both the forum to create and improve standards within the industry, as well as the lobby for same.

“A lot of the complaints… …that are heard by UStiA members generally relate to people thinking something is covered that is not,” she told us.

Then we talked to Ellie von Wellsheim, the founder and CEO of The Mooncatcher Project--a non-profit that provides reusable menstrual pads to school-age girls in developing nations to help them continue their education. Part of her job entails frequent travel to the countries the organization services--countries that often have substandard medical facilities or experience a higher-than-average rate of natural disasters or political instability. Travel insurance is an essential and frequent purchase for her and the organization.

“I’m going to extremely poor places where medical hospitals are pretty bad,” she told us. “I want to know that I’m covered. Because something could happen to me. The airline offered insurance is only for your travel. It doesn’t cover you if you have to be medevaced out of the country.”

Finally, we constructed our own hypothetical trip based on one of our coworkers, and plugged his information into all the insurers we researched to see what his coverage would look like. We “sent” our imaginary 38-year-old colleague to France from Washington, D.C. on each of these sites, using the same travel dates and a projected cost of $3,000 for the trip. We tended to skip the bare bones policies in favor of more comprehensive options, since the price bump was generally less than $50. We figured that if you’re already paying for travel insurance, the small extra expense if well worth the extra peace of mind.

Though not a perfect predictor of value across demographics, destinations, or trip costs, it does provide a benchmark for coverage that we can work with.

Coverage

Coverage is the undisputed king in the realm of travel insurance. The single most important thing to look at is your policy and what’s on it. As a travel insurance customer, you need to be crystal clear on how much protection you are buying, as well as what circumstances are not covered.

Extra Benefits

Because many coverage options are fairly standard in the industry, varying mostly by dollar limits, insurers add extra benefits to plans to entice buyers. These benefits can range from concierge services in the event of a flight delay up to legal assistance in a foreign country. In the event of a crisis, you can’t put a dollar amount on the value of these vital services.

Price & Reputation

Coming in at a distant third place is price. As typically a one-time expense, travel insurance is pretty affordably priced. However, high end, high risk policies can cost up to 10% of the price of a trip. But the savings or financial reimbursement in the event of calamity make it a bargain at twice the price.

Introduction to Travel Insurance

Insurance.

Let’s be real, nobody likes insurance. Ask the next five people you talk to what they think about insurance and we guarantee you’ll get an earful. Ask five more and you’ll just hear more of the same. Go on, we’ll wait.

The reputation of insurance providers is so bad that a 2017 study on public perceptions of various industries and entities shows the insurance industry as a whole earned a net favorability rating of -32. That’s worse than such widely reviled bodies as Congress and Wall Street. To say the insurance industry has an image problem is putting it mildly.

Though there are some legitimate reasons for this widespread unpopularity, part of the issue is a fundamental misunderstanding of what insurance actually is. Many people think insurance--whether travel, health, auto, home, etc.--is like a big bucket of money you add to over time and can draw from for any reason when anything bad happens to you.

As fantastic as this “rainy day savings account” would be for the consumer, the simple fact of the matter is that such a system would collapse on itself overnight as hundreds of thousands of claimants all raided the kitty at the same time.

Insurance premiums are set based on a mathematical balance between an expected loss number and the total number of insured individuals so that the pool will be large enough to cover all claims. If it costs X amount of dollars to pay out a given type of claim, you need to set premiums based on the expected frequency of that event.

Pretty grim stuff, certainly, but the science of predicting the frequency of accidents, losses, or other calamitous events is essential to the entire process of insurance. And without insurance, there is no commerce, no economy, and no modern world. The commercial container ships that carry the food, clothing, electronics, and other consumer goods we all buy every day typically cost more than $100 million dollars, not including the cargo. Insurance makes that possible. Who among us can afford to risk that much money in the uncertain world we live in, full of storms, pirates, and mechanical failures? Insurance spreads out unmanageable risk; thinning it to a much more acceptable level.

Acceptable, certainly, but by no means fully absent. A frequent complaint people have about insurance companies is that they never pay out on claims. Payout rates vary across the many different types of insurance, but travel insurance generally pays out claims at higher rates. While there certainly may be some funny business going on by the insurer in at least a few cases, the single biggest reason why claims are rejected is that the policy as purchased specifically did not cover the claimed loss.

Acceptable, certainly, but by no means fully absent. A frequent complaint people have about insurance companies is that they never pay out on claims. Payout rates vary across the many different types of insurance, but travel insurance generally pays out claims at higher rates. While there certainly may be some funny business going on by the insurer in at least a few cases, the single biggest reason why claims are rejected is that the policy as purchased specifically did not cover the claimed loss.

Insurance policies are legal contracts that spell out exactly what is and what isn’t covered. We’ll talk a little about certain ambiguous words that leave room for interpretation later. For now, suffice it to say that for the most part you should be able to read a policy and know with 99% certainty what you can expect to be covered. If it isn’t expressly covered, or if it’s specifically not covered, you really shouldn’t get too bent out of shape if your claim is denied. In a sense, it’s like getting mad that the wrench you bought for a home project isn’t a very effective hammer.

What is Travel Insurance?

We’ve discussed what insurance is generally, but have so far skirted around the main theme of this article: What exactly is travel insurance?

Travel insurance is both exactly what you’re thinking and so much more. Amazingly, while most people are pretty cautious in their regular lives, often having policies for homeowner’s or renter’s, health, auto, and sometimes life insurance, very few people--only 7%!--regularly buy travel insurance. Considering that the average American spends 25-35 days a year travelling, and that Medicare and a lot of American health insurance policies don’t provide coverage overseas, that means there are literally millions of Americans who are entirely uninsured for a whole month out of the year.

Now consider that the first thing most people do when they go through airport security is take off their shoes and throw out their bottled water. We readily submit to these security protocols because they make us feel safe. This even though the average American is more likely to die from choking on their lunch than by a terrorist attack. While you could make the argument that these enhanced security measures are the reason for the low number of terrorism related fatalities, the expert consensus is that security theater is reactive and largely ineffective.

Now consider that the first thing most people do when they go through airport security is take off their shoes and throw out their bottled water. We readily submit to these security protocols because they make us feel safe. This even though the average American is more likely to die from choking on their lunch than by a terrorist attack. While you could make the argument that these enhanced security measures are the reason for the low number of terrorism related fatalities, the expert consensus is that security theater is reactive and largely ineffective.

We bring this up not to bring you down, but to illustrate how strange it is that we can be so concerned with one aspect of travel safety and take such massive risks in others.

Nor are we suggesting that travel insurance is all about bodily safety. Indeed medical coverage is but one aspect of travel insurance. In fact, the number one reason people purchase travel insurance is trip cancelation coverage. Eighty eight percent of respondents to an AAA Travel phone survey cited trip cancelation as their number one concern. Health concerns, by the way, rated 69%.

These concerns bring up a good question - what exactly does travel insurance cover?

What’s Covered?

Travel insurance, much like any other type of insurance, covers an agreed-upon set of circumstances as set forth in the insurance contract. Coverage options fall into roughly five unofficial categories, which include the previously mentioned cancellation and health coverage, auto insurance, and issues with baggage. The fifth bucket includes unusual types of coverages, such as hijacking insurance, extreme sports coverage, and other options in less common demand.

Under each of these coverage areas are a slew of options that may or may not be exactly what you need for an upcoming trip.

| Health/Medical | Covers |

| Medical Insurance | In-country access to medical and emergency medical facilities. However, there are two types of medical coverage with travel insurance: either primary or secondary. In the latter case, your travel insurer reimburses you after any other insurance coverage reaches its limit. Essentially, this means that the medical coverage from your travel insurance policy kicks in once your regular healthcare coverage is exhausted, or if it doesn't cover you at your destination. Primary medical coverage, on the other hand, pays first regardless of any other coverage you may have. This allows you to only have to file one claim, rather than two. It's most common in annual or multi-trip policies, though some single-trip plans may also offer primary coverage. |

| Medical Evacuation | Emergency transport to your hospital of choice around the world. When choosing medical evacuation coverage, it’s important to have specifics about the plan’s network of health facilities. If you’re traveling to Nepal to do some mountain climbing, and the closest in-network hospital is in Finland, you probably want to keep shopping. |

| Emergency Dental | Broken teeth, infection, injury, lost fillings, etc. Cosmetic fixes are not covered. Coverage is typically limited to $500-$1000. |

| Accidental Death & Dismemberment | Limited life insurance benefits in case of accidental death. Partial payouts for loss of limbs or appendages. |

| Repatriation of Remains | The return of bodily remains in the event of death overseas. |

| Additional Benefits | Some medical insurance or medical evacuation insurance will pay to fly a family member to the overseas hospital where you’re being treated if it’s determined that you’ll be there for some time. |

| Auto Insurance | Covers |

| Auto Insurance |

Pretty self-explanatory. Covers the same things domestic auto insurance covers, but for international rentals. |

| Cancellation/Interruption | Covers |

| Cancellation | Provides reimbursements for prepaid and nonrefundable expenses on a trip when the insured must cancel due to a health emergency, natural or weather disaster, terrorism event, as well as a number of other incidents. |

| Interruption | The counterpoint to cancellation. This covers trips that have to be cut short in case of events such as natural disasters, terrorist attacks, illness, etc. In certain cases, interruption insurance will pay to return the traveler back to the interrupted trip. Think of it a little like hitting pause on the movie you’re watching in order to deal with the popcorn you just realized was burning in the microwave. Once you clean up the mess and air out the smoke, you can go right back to watching your movie. |

| CFAR | “Cancel for any reason”: the Cadillac of cancellation coverage. These policies are more expensive than general cancellation coverage. They also usually only cover 50-75% of the cost of your trip. This is more geared to people traveling to potentially dangerous locales who might be monitoring the news to decide if it makes sense for them to take the trip after all. It should be noted that CFAR insurance is not available in New York because the authorities there have determined that it does not meet their legal definition of insurance. |

| Baggage | Covers |

| Lost, stolen, or damaged luggage | Reimbursement for the value of lost, stolen, or damaged luggage. Pay attention to coverage limits and increase as necessary. Some policies, for instance, specifically don’t cover electronics like laptops or cellphones, or put such low caps on reimbursements that the loss of expensive electronics won’t be covered. |

| Delayed luggage | The replacement of temporarily delayed (think 24-48 hours) essentials like toiletries, medication, etc. Generally this is capped at $100 per day per person. |

| "Other" | Covers |

| K&R |

Kidnap and ransom insurance is typically only used by the very wealthy or famous, or by companies with high value employees travelling to certain kidnap-prone areas. K&R insurance doesn’t just cover the hefty ransom payments sometimes necessary to secure the release of the hostage(s). Typically a policy will provide assistance in the form of experienced negotiators who both increase the survival rate of hostages from 9% mortality to 2% and decrease ransom payments down to 10% of the original sum demanded. K&R insurance is interesting in that most of the time the insured party doesn’t know he or she is covered. This is to prevent “self-abduction” scams to collect on the insurance. |

| Cruise Insurance |

Because cruises typically make a number of international stops during the journey, can sometimes last for months, and passengers have to travel to the port of embarkation from all over the US, cruise insurance is a pretty unique product in the industry, with enhanced cancellation coverage. Typically it also covers medical issues. A word of caution: it’s not a good idea to buy cruise insurance from the cruise line itself. Such policies are often written to benefit the line over passengers in an insurable event. Always go with a third party insurance provider and always shop around. |

| Specific Event Insurance | Allows for the cancellation of the trip if the specific reason for the trip--an event such as a concert or festival--is canceled. |

| Group Insurance |

If you’re traveling with a group, whether for work, as a team, or on a church trip, etc., it may be worth looking into group insurance. Depending on the size, composition, and destination of the group, a group policy may make more sense than insuring each individual. At the very least, group travel policies are not dependent on age, which can significantly lower policy prices. |

In addition to coverage options, it’s worth looking at extra benefits provided by travel insurance companies. UStiA Director Megan Cruz told us that these “non-insurance services can include legal assistance, they can include help with lost travel documents, 24-hour assistance to make alternate travel arrangements or even coordinate emergency medical care.”

This suite of “extras”--concierge customer service options--really make the difference between a good insurance provider and a great one.

Your Policy

The Fine Print

People commonly think of insurers as miserly bureaucrats who get their kicks denying claims. Policies are almost thought of as “sell your soul” contracts riddled with devious loopholes and the type of fork-tongued language lawyers salivate over.

And while it’s true that these documents contain more than their fair share of legalese, there is a reason for that. An insurance policy is a contract. By definition it’s going to have the kind of “contract-y” language most of us skim-read with glazed eyes if we even bother to look at it at all. That’s the bad news. The good news is that with a little patience you can fully understand the contents of your policy to see what is and what isn’t covered.

Loopholes--as they’re commonly understood--do not exist in insurance policies. While coverage can be denied for a number of reasons (drug or excessive alcohol use, for instance), those reasons are clearly laid out in the policy contract. There is no “get out of paying all claims free” card cleverly hidden in the contract to give the insurer a universal out. Though insurance companies aren’t much trusted by consumers or even terribly well-liked, they obviously wouldn’t last very long as a business if they just swindled their clients.

Study your policy--we know, it has all the excitement you’d expect from the reading of the minutes of a school board meeting. Nonetheless, read the whole thing and make notes where you have questions or something isn’t clear. Travel insurance comes with a 10 or 15 day “free look” clause where you can cancel the policy for a full refund any time within that period. Use the time to call your insurer and ask questions specifically pertaining to your trip. If you don’t like the answers, ask for changes to be made, or cancel the policy. You can cancel at any time during the free look period for a full refund.

As far as legalese, probably the most basic thing you want to look out for is whether the language in the contract is exclusive or inclusive. What this means is that the policy will either expressly outline all covered circumstances (inclusive), or spell out everything that is not covered (exclusive). If, for instance, the contract uses exclusive language and a particular thing is not specifically named, you can expect that scenario to be covered. Conversely, unless an inclusive contract tells you something is covered, it’s not.

Exclusive contracts tend to be rarer because it’s harder to compile a comprehensive list of everything that wouldn’t be covered. This creates more risk for the insurer but is definitely more attractive to the customer. If, for instance, there ever was a real life sharknado, such an event is more likely to be covered in an exclusive contract--because who would ever think to list it among the exclusions?--than an inclusive one.

Another thing to look out for is modifiers like “reasonable.” Our killjoy editor recently bought travel insurance for a trip to South America and found the following under “Benefits” when reading over his policy:

What you deem “reasonable” might be pretty different from what we or this insurer does. While we can all agree that a common cold isn’t a valid reason to cancel a trip, what is? The flu? Losing a finger? Losing a hand?

A lot hinges on this one word. We’re not suggesting that the insurer would go so far as to determine that Ebola isn’t a reasonably disabling condition to cover. We just want you to know that if you have questions about something in your policy, you can and should call the provider to ask for clarification.

So, what can you expect to be covered by your insurance?

Let’s put together a hypothetical trip to find out. You and your younger brother saw a special on land diving in Vanuatu and decide you absolutely have to go try it. As we’re sure you’re aware, there are no direct flights to Vanuatu from any airports in America, so you buy a ticket through Fiji. On the flight over, your luggage somehow misses the connecting flight and gets delayed for two days. You guys pack light, so it normally wouldn’t be a big deal except that your brother is a diabetic and accidentally checked his insulin.

Hey, he was excited about the trip and wasn’t thinking clearly, ok? Everyone makes mistakes.

When you finally get to Vanuatu and see the 80 foot scaffold you’ll be diving from, you understandably have second thoughts. Unfortunately, the tour company you booked with does not offer refunds--turns out you’re not the first one to get cold feet.

As the younger sibling, your brother decides he has something to prove and goes ahead with the jump. Predictably, he breaks his collarbone and has to go to the hospital a couple hours away. While he’s getting patched up, you decide to have a few drinks to calm your nerves and end up twisting your ankle on the uneven bamboo floor of what turns out to be a very rustic bar in Port Vila.

Now you’re also in the hospital and you end up calling the airline to push your flight back a few hours, which means you end up missing your connecting flight in Fiji.

So what parts of this calamitous trip does your travel insurance pay for?

Well, that obviously depends on the policy you bought. Here are the things you’ll want to make sure are in the contract:

- The whole point of this trip is to go land diving, which is about as extreme an extreme sport as there is. Most policies will not cover activities like this, so you’ll have to purchase extra coverage, and that’s going to cost you. Without this option, it’s likely that your brother’s injury would not be covered by standard medical protection.

- Delayed luggage protection is pretty standard in travel insurance policies and prescription drug coverage is not uncommon. Still, double check that it’s in the contract and how much is covered. Delayed luggage protection doesn’t replace your valuables; it only pays for essentials you need in the gap between when your luggage gets delayed and when it finally reaches you.

- Even though reimbursements for non-refundable tours or activities is common in travel insurance, your claim will likely be denied because the reason you weren’t able to participate in the booked event is that you were too afraid to go through with it. We’re not judging--land diving looks terrifying!

A Note On Alcohol Use

What about the rest of the trip? Your visit to the hospital for your twisted ankle? The missed flight in Fiji?

Unfortunately for you, you voided the rest of your coverage by being drunk. Standard in most travel insurance policies is a drug and alcohol exclusion that won’t pay out if you’re intoxicated. You were drunk when you twisted your ankle, which means that your hospital visit was not covered. And because your injury caused the delay which caused you to ultimately miss your connecting flight, that most likely wouldn’t be covered either.

This is the closest thing to that mythical “get out of paying all claims free” card as you’re likely to find in a travel insurance policy. And, to be frank, it makes sense not to cover incidents that happen while the insured is intoxicated. Of course there is some wiggle room in what constitutes intoxication. If you had a glass of wine with dinner and injured yourself somehow, your medical coverage will probably be honored. But if you sprain your throwing wrist by playing four straight hours of beer pong, you’re on your own.

For the final word on what to look for in a travel insurance policy, we asked Megan Cruz for an insider’s perspective of what she looks for when she buys travel insurance (yes, the Executive Director of the US Travel Insurance Association buys travel insurance almost every time she travels). She answered: “I’m going to look at what’s covered and I’m also going to look at the limits of the insurance offered by the carrier, and I always read the fine print. I know those coverage limits so I’m not surprised later. I think about other costs in addition to my flight.”

Common Exclusions

Policies can vary greatly from insurer to insurer and based upon the circumstances of you, the insured. Just as there are some commonalities in coverage options, there are also a number of exclusions you’ll see popping up often.

The first of these exclusions--and one we feel comfortable stressing--is for claims for incidents that occurred when the insured was intoxicated due to drug or alcohol use. Besides common sense, there are a number of fundamental insurance principles that would be broken if such an exclusion were not made, but we’ll focus only on one. The insured event must not be under the control of the insured. And while it’s certainly true that intoxicated individuals are generally not in control of whatever situation they find themselves in, by becoming intoxicated, they have essentially made the decision to make bad decisions. For similar reasons, gambling is not covered by other types of insurance because the insurer is bringing unmanageable risk upon him or herself.

Similar to this is the exclusion for stolen baggage if you leave said baggage unattended. Flirting with disaster, or otherwise exercising poor judgment is generally not insurable. Which brings us to the next item on the list.

Extreme sports such as skydiving, bungee jumping, etc. are typically excluded from ordinary travel insurance policies. In fact, traveling to compete in ordinary sporting events, such as baseball and football is also usually excluded. Additional insurance can be purchased to cover these and many other otherwise excluded activities… at additional cost.

Cancellation due to weather can be excluded in certain cases. Most commonly this exclusion applies when traveling to a region prone to hurricanes once the storm has been given a name. This happens when the storm reaches wind speeds of 39 mph. Keep an eye on the weather where you’re traveling and plan accordingly. Unfortunately, storms are unpredictable things, so if you cancel your trip, there’s a chance that the storm will veer off course and miss your destination, or run out of steam. While this is certainly good news for those living in what would have been the path of the storm, it does mean that you’ve ultimately canceled your trip for no reason.

The broadest and probably most widespread exclusion is for pre-existing medical conditions. Pre-existing conditions don’t necessarily mean something you’ve struggled with for years. Instead, the insurer will investigate the last 60 to 180 days of your medical history in what’s called the “look back period” to see if you were “medically stable” i.e. you did not exhibit active symptoms. If there is an issue, you can purchase an exclusion waiver for pre-existing conditions. Of course, this comes with an additional cost.

Some exclusions can ultimately be covered with the purchase of additional insurance, while others cannot. When in doubt, consult your policy and call the insurer. Common sense will provide some answers as well. If the scenario you want to insure sounds ridiculous to you, it’s probably excluded.

Medical Tourism

As healthcare costs in the US skyrocket, medical and dental tourism are becoming popular for travelers of all ages. Countries with safe, affordable, top-level medical care such as Mexico, Thailand, Costa Rica, and others are attracting visitors looking to have both elective and medically necessary procedures performed for a fraction of what they would cost back home.

Though medical care in other countries is typically very safe--particularly if you’ve done your research and chosen trusted clinics or doctors--travel insurance providers almost universally do not cover medical tourism. Remember, insurance exists to cover unforeseen events; planned events that increase risk and uncertainty are generally uninsurable.

In fact, undergoing an elective procedure while on an insured trip can cause the rest of your coverage to be terminated. If, for instance, you miss a flight or are robbed after undergoing elective surgery, it can (and will) be argued that whatever medications you are or were on contributed to the unfortunate event. In short, in your insurer's eyes, you’ve rendered yourself uninsurable.

A very few insurers do sometimes offer policies specifically tailored to medical tourists, but these seem to disappear off the market quickly. Other insurers sometimes cover the parts of your trip not immediately associated with whatever procedure you’re having done--but only sometimes.

Because medical tourism insurance is an emerging travel service and its availability is so unpredictable, we can’t in good conscience recommend a provider. But as more people opt for treatment overseas, it’s likely that the insurance market will adjust to meet the demand for this type of coverage.

What to Do If You Need to File a Claim

Insurance is one of those things you buy in the hope of never having to use, much like a fire extinguisher or a snake bite kit. In the unfortunate event that you do have to make a claim, there are a few things you can do that will help ensure that your claim will be approved in a timely manner.

The first step, again, is to have read your policy to understand exactly what is and is not covered. If the circumstances of your injury or loss are expressly excluded from coverage in the text of your policy, the likelihood of your claim being approved is slightly less than that of being struck by lightning while winning the lottery. In other words: it ain’t gonna happen.

When filing a claim, your two best friends are speed and documentation. Time is definitely of the essence when filing a claim. The sooner you file, the better off you’ll be. Thorough, dated documentation, in the form of both receipts and--depending on the nature of your claim--a physician’s note or police report, is an absolute must. If something is stolen or you are attacked in some way, absolutely file a report--get it in writing and get a copy to give to your insurer.

It’s a good idea to keep a copy (physical or electronic) of your policy as well as contact numbers for your insurance provider with you as you travel. That way you won’t waste any time searching around for that material in the middle of a crisis.

It’s a good idea to keep a copy (physical or electronic) of your policy as well as contact numbers for your insurance provider with you as you travel. That way you won’t waste any time searching around for that material in the middle of a crisis.

If your claim is denied, don’t panic and don’t take that initial no for a final answer. Ask why, specifically, it was denied and find out the process for resubmitting the claim. Make sure to get the reason in writing. It might just mean that more documentation or evidence is necessary to validate your version of events, not that the event in question isn’t covered.

If after doing everything right and having your claim denied again, you feel that you’re entitled to restitution, you can always hire a lawyer to advocate on your behalf. There are, in fact, lawyers who specialize in advocating for clients who’ve had insurance claims denied. Yes, it’s annoying and time consuming, but it can mean the difference between getting the pay out you deserve, and walking away with nothing.

Do You Need Travel Insurance?

Officially our answer is “absolutely you do.” If you choose not to insure your trip and something happens, don’t say we didn’t warn you.

Unofficially, it’s really up to you, except that entrance to certain countries requires travel insurance. Also, when traveling with certain groups or organizations, the administrators of the trip might require travel insurance in order to participate. Study abroad programs, for instance, often require a policy.

As previously discussed, insurance is an instrument used to mitigate risk. Each of us has a different tolerance for risk and a different sense of what is and what isn’t risky. A tour of a peanut farm for most of us isn’t a risky activity, but for those with a peanut allergy, it just may be the last tour they ever take. By that same token, pretty much anyone would consider the running of the bulls in Pamplona a highly risky activity. Whether or not that prevents you from participating is another story.

As previously discussed, insurance is an instrument used to mitigate risk. Each of us has a different tolerance for risk and a different sense of what is and what isn’t risky. A tour of a peanut farm for most of us isn’t a risky activity, but for those with a peanut allergy, it just may be the last tour they ever take. By that same token, pretty much anyone would consider the running of the bulls in Pamplona a highly risky activity. Whether or not that prevents you from participating is another story.

Travel is no different. Most of us wouldn’t insure a $130 flight from Philadelphia to Boston, for instance, because we’d consider $130 an acceptable loss in the event that something went wrong and we couldn’t go on the trip. We wouldn’t be happy about it, certainly, but it also wouldn’t be the end of the world.

If, however, you have a severe medical condition, it may make sense to insure yourself for even short weekend trips like this. People with certain medical conditions both live with a higher level of risk in their daily lives and have a lower threshold for what is an acceptable risk.

Even if you aren’t at greater risk for accident, injury, etc., you could decide you wanted to insure this hypothetical $130 trip. It’s entirely up to you how much risk you’re comfortable with.

An expensive, once-in-a-lifetime trip should definitely be insured. We looked into ticket prices for that hypothetical trip to Vanuatu and they were about $1,500 per person from Los Angeles. If you live on the east coast you’ll need to tack on another $400-800 to make the LA flight. Not many people can swallow such a loss and not feel it.

Even worse is that most American of trips: the family vacation to Disney World. With airfare, lodging, park passes and food, a family of four can expect to pay around $5,000 for a week long trip. That’s about 8% of the average annual household income in America--$62,000. That’s a lot of money to flush down the drain because you weren’t insured.

Again, we can’t tell you how much risk you should deem acceptable. If you’re comfortable rolling the dice and paying $1,000 to fly from New York to Warsaw without travel insurance, we won’t stand in your way. And if you feel like insuring that weekend trip to Boston against every possible eventuality, that’s your prerogative.

Alternatives to Travel Insurance

It’s worth noting that there are some alternatives to travel insurance, though as ever, you’ll need to read the fine print.

What the Airline Can Do for You

Airlines will often reimburse you in part or in full if your flight is canceled or delayed if the problem is the airline’s fault. More commonly, they will book you a seat on the next outbound flight going to the same destination. If your flight was the last of the day, the airline will often provide you with lodging for the night, as well as a meal allowance. However, these policies vary depending on the airline--it’s a good idea to read up on your airline’s policies before your date of departure to see what they will and will not do for you in the event of a screwup.

Even if an airline offers little upfront assistance in the event of a cancellation or delay, you’d be surprised what you can get by simply asking for it. Airlines are, after all, in the service industry. And though they don’t have the best reputation for customer service, they are surprisingly responsive to direct complaints.

Meanwhile, if you’re bumped off of an overbooked flight, you might have just hit the jackpot. According to the US Department of Transportation, delays can earn you a nice chunk of change. If your travel plans allow for some wiggle room, it could be well worth your while, headaches aside.

Whatever happens, though, nothing says you have to accept the airline’s first offer. You can and should negotiate better reimbursement for yourself.

What Your Health Insurance Can Do for You

Your existing health insurance may provide coverage in the event of an emergency... or it may not. It’s worth a call to your insurance provider before you travel to see what kind of coverage you can expect, if any. Typically what happens, if you’re covered, is you’ll pay out of pocket at the hospital or clinic and then your insurance provider will reimburse you upon your return home. What it almost certainly won’t do is provide coverage for medical evacuation. Very few plans offer that kind of coverage.

Ellie von Wellsheim, who travels to developing countries with generally poor medical care, insists that all of her volunteers purchase travel insurance when traveling to areas The Moon Catcher Project services. “I do say that I would like them not to just have travel insurance, but to have health insurance,” she told us, noting that your domestic insurance doesn’t always work overseas. “Look into your insurance and find out if you’re covered for medical expenses, but understand that if something catastrophic happens, you need to get out of the country, and can you afford $10-$15,000 to do that?”

Further, she noted that Medicare does not work outside of the country. If you’re insured through Medicare and are traveling overseas, it would not be a good idea to forgo medical travel insurance.

What Your Credit Card Can Do for You

Certain credit cards cover some of the same territory as travel insurance. Typically these are not the fee-free cards most people have to pay for unexpected car repairs or to replace the washing machine when it dies. These are premium cards with high fees that require above average credit. But the benefits are certainly well worth the fees.

With medical, including evacuation, lost or delayed luggage, auto, trip cancellation coverage and more, some of these cards completely take the place of travel insurance. Though they are more expensive than travel insurance policies on a single trip basis, if you’re taking more than one international trip a year, they could easily end up saving you money.

FAQs about Travel Insurance

Can I cancel the policy and get a refund if I change my mind?

Can coverage be denied due to a pre-existing medical condition?

What does travel insurance cover?

Will my regular health insurance cover me overseas?

How much does travel insurance cost?

The website I buy plane tickets from lets me buy insurance when I check out. Should I?

Does travel insurance apply to business trips?

While there is a great deal of similarity between the two, you may want to look into specific event insurance for your business trip. If your big sales meeting with Brand X Industries is cancelled at the last minute, you’re probably not going to continue with the trip after all.

I see some insurers offer annual policies. Are they better than buying insurance trip by trip?

Popular Comparisons

Our Travel Insurance Review Summed Up

| Company Name | Best for |

|---|---|

| TravelInsurance.com | Price Guarantee |

| Travelex Travel Insurance | Customizable Coverages |

| RoamRight Travel Insurance | Comprehensive Range of Coverages |

| Insure My Trip Travel Insurance | Customer Service |

| World Nomads Travel Insurance | Travelers and Guidebook Publishers |

| Generali Global Assistance Travel Insurance | Trip Cancellations and International Support |

| Allianz Global Assistance Travel Insurance | Households and Businesses |

| Medjet Travel Insurance | Medical Air Transport |