Best Gold & Silver IRAs of 2024

- 200+Hours of research

- 20+Sources used

- 20Companies vetted

- 4Features reviewed

- 5Top

Picks

- Gold IRAs are a type of self-directed individual retirement account

- The four precious metals allowed by the IRS are gold, silver, platinum and palladium

- Precious metal IRAs can be traditional or Roth IRAs

- Gold IRAs can be beneficial to investors looking to diversify their portfolio

How we analyzed the best Gold IRAs

Our Top Picks: Gold IRAs Reviews

With over a decade's experience, California-based Goldco is a provider of precious metal retirement accounts, including Gold and Silver IRAs. The company has sold $700 million in precious metal assets. Its focus on quality customer service and extensive educational materials make the company an option well worth consideration for customers of all investment experience levels.

REPUTATION

During our research, we noticed that Goldco has a strong reputation for providing excellent customer support and helping customers understand the investment process. The vast majority of online reviews are positive, and the company is an accredited business with the BBB with an A+ rating. It also holds an excellent 4.7 out of 5 score on Trustpilot. This cannot be said of many other precious metal IRA providers, giving Goldco a leg up on its competition.

FLEXIBILITY

For precious metal IRAs, Goldco offers gold and silver, as well as platinum and palladium. These are typically the most popular precious metals used with these types of self-directed IRAs. Goldco customers can purchase with confidence knowing that, if their financial circumstances change and wish to get out of the precious metals market, Goldco will buy back the metals they've sold you at the highest market price at the time of sale.

Customers can either open a new self-directed IRA or roll over an existing retirement account— including 401(k)s, 403(b)s, 457, pensions, and TSP accounts— to take advantage of Goldco’s precious metal IRAs. Customers own the physical metals in their IRAs, which are securely stored in a vault at an insured depository. They have access to their precious metal assets at any time upon request. Penalties may apply if you take your precious metals out of your retirement account before funds become eligible for distribution according to IRS rules.

In addition to the precious metal IRAs it offers, Goldco also allows customers to purchase gold, silver, and other precious metals directly for self-storage. Self-stored assets are not eligible for saving in an IRS-approved, tax-advantaged retirement account.

FEES, PROMOTIONAL OFFERS AND TRANSPARENCY

Although Goldco’s website does not offer details regarding the pricing of Precious Metal IRAs, it does explain that the costs are charged as a yearly flat fee instead of a percentage of the assets contained in the IRA. This is an industry-standard practice and Goldco mentions that storage fees are determined by custodians and depositories. Goldco conducts monthly promotional offers and most customers qualify for up to 10% in free silver with qualified accounts. The company suggests that customers talk with a Goldco representative in order to get information about pricing and current promotions. Goldco’s Buy Back program guarantees that the company will purchase your precious at the highest price should you decide to liquidate your investment.

CUSTOMER SERVICE AND EDUCATION RESOURCES

Goldco’s online educational resources are some of the best we’ve seen from precious metal IRA providers. One of the most useful resources they offer is their Beginner's Guide to Gold IRAs. The company publishes a precious metals investment blog that offers information on economics, the Federal Reserve, retirement planning, and how current events and political circumstances may affect your finances. Interested customers can also request a free kit that gives you summary of what to expect during retirement and how investing in precious metals can help you reach your financial goals.

As for customer service, Goldco has extremely positive online reviews that speak to the company’s support for new and experienced investors. Customers can contact Goldco’s support team via chat, email, or phone call, available Monday through Friday, between 7:00 a.m. and 4:00 p.m. (PT).

Established in 1997, Lear Capital is a leading provider of gold and silver IRAs. It's among the oldest companies in the precious metals arena and reports that it has one of the largest inventories in the industry. The company boasts over $3 billion in sales to over 90,000 customers. Lear is heavily focused on consumer education and customer satisfaction, offering a price match and 24-hour risk-free purchase guarantees. FLEXIBILITY

The company sells IRA-eligible gold and silver in both bars and coins for investors looking to transfer or rollover their IRA or 401k into a self-directed retirement account. The rollover is tax-free and taken care of by a Lear Capital team member and your current IRA custodian. The entire process is detailed in Lear Capital’s Price Advantage Guarantee, which includes a phone confirmation and a written confirmation, as well as a written account agreement.

FEES

For qualifying portfolios, Lear will cover up to 3 years of custodial fees, which includes storage fees - up to a $680 value. They cover the IRA set-up fees for all accounts. One of Lear’s unique benefits is cost-free flexibility for your first year. If you want to make changes to your portfolio at any time within the first year of your initial transaction, Lear gives you the flexibility to make those changes at no charge. And when the time comes to liquidate, Lear never charges any fees to sell your metals.

CUSTOMER SERVICE

Lear Capital's customer service hours are weekdays 7:00 am to 6:00 pm. The company has both a 1-800 number and a customer service email address prominently displayed onlineso you don’t have to go hunting for them. When you do business with Ler Capital, you work with one representative from start to finish. Any time a customer calls,he or she is immediately directed to an assigned representative’s desk. No switchboard or a phone tree involved. This makes asking questions or getting updates faster and less tedious for account holders. Lear’s website offers an extensive learning center with a very thorough list of FAQs. They are the only company we found that offers a “required minimum distribution” calculator for customers, which is very helpful for both planning purposes and for those in the RMD phase of retirement. They also have a great mobile app that can help walk you through an IRA from start to finish, as well as other nice

REPUTATION

Lear has a strong reputation for treating customers well and helping them understand their investment options. The company has a 27-year track record and over 90,000 transactions on the books. They have a solid 4.9 rating on Trust Pilot with over 600 reviews. The overwhelming majority of reviews on the site rating the company as “excellent”. Lear Capital is accredited by the Better Business Bureau, holding an A+ rating.

Lear Capital has a strong reputation and offers easy-to-understand terms and fees, a plus in the sometimes complicated world of gold and silver IRAs. Its single yearly fee including storage and insurance is hard to beat in the precious metal marketplace, and the company promises attention to detail across its robust customer service platform.

Valuing Customer Relationships

Patriot Gold Group offers a unique value proposition among gold IRA companies, promising that all customers are free to speak directly with someone who has an ownership interest in the company—regardless of whether they already have an account. We were a little skeptical, so we tested that claim and called Patriot Gold Group. Sure enough, the senior account executive offered to transfer us to an owner of the company, who he referred to by his first name. Whether or not you find that compelling, it points to a few more characteristics that make Patriot Gold Group stand out from the crowd.

How A Small Company Can Offer Big Value

Patriot Gold Group has only 15 employees, including its owners. According to the company, its flat organizational structure translates into lower costs for customers. With many precious metal IRA companies, customers will speak with a string of staff members, each of whom receives a commission for serving your account. At Patriot Gold Group, however, the first person you first speak with may be the last person you speak with during the application process (unless you want to speak to a company owner, that is). Because Patriot Gold Group pays fewer employee commissions, the company states that it is able to offer better pricing: the most metal in your account for the fewest dollars. In addition, the company does not employ a tiered pricing structure on precious metal purchases: you pay the same price for each coin or bar you purchase no matter how large your order.

Impressive Reputation

Patriot Gold Group is accredited by the Better Business Bureau and earns an A+ rating from that organization. BBB ratings, however, don't always directly reflect customers' feelings about a company: the BBB has its own rating calculus that takes into account multiple factors. But in Patriot Gold Group's case, customer sentiment aligned perfectly with the company's official rating. Customers award the company 5 out of 5 stars and, remarkably, there have been zero complaints filed against Patriot Gold Group through the BBB. In addition, the company earns 4.7 out of 5 stars from reviewers on Trustpilot and has been Consumer Affairs' top pick among Gold IRA dealers for several years running. The company earns accolades for the knowledge and patience of its staff and for the smoothness of the IRA application and funding process. Our experience with the staff member we spoke with was similarly positive.

Deposit Requirements and Fees

The minimum investment you must make to fund a precious metals IRA through Patriot Gold Group is $25,000. The company's cost of entry is, therefore, higher than some competitive gold IRA firms. The company offers free storage and account management to all customers, but.the amount of time you'll enjoy free services varies with the amount of your initial deposit:deposit:

| Initial Deposit Amount | Free Storage and Account Management Term |

| $25,000 | One year |

| $50,000 | Two years |

| $75,000 | Three Years |

| $100,000 | No fees for the life of your account |

After your free service term ends, you can expect to pay $200 per year to maintain your precious metals account.

Summing it Up:

Investing in precious metals is one way to hedge against the volatility of other investment vehicles, such as the stock market and cryptocurrency. While the precious metals market does have its own ups and downs, it's a pretty sure bet that gold and silver will never lose all of its value. Most financial advisors will recommend that you invest in precious metals conservatively. It's a good way to diversify your portfolio, but history demonstrates that precious metal investments don't offer the same potential for rapid growth as other kinds of investment you might make. But if you do choose to open a precious metals IRA, Patriot Gold Group is well worth your consideration. The company's stellar reputation, emphasis on customer service, its same-across-the board pricing model, and its low storage and management fees, make Patriot Gold Group a good choice for both novice and experienced precious metal investors.

A Highly Reputable Company

Founded in 2015, American Hartford Gold is a family-owned company that enjoys an excellent, A+ rating from the Better Business Bureau and earns 4.9 out of 5 stars from reviewers on Trustpilot. That's not to say that consumers don't have complaints about the company, but there have been remarkably few filed. And that's especially unusual with financial services companies. Customers praise American Hartford Gold's customer service, indicating that the sales experience was low-pressure and that the company's gold experts were generous with their time and provided clear answers to their questions.

The company also stands out for a privacy policy that is unusual among precious metal purveyors, promising not to sell your information to other companies for profit. That stems an unwelcome tide of unwanted emails and phone calls from companies you've no interest in doing business with.

Choices for Investors and Collectors

American Hartford Gold offers gold products and silver products that are IRS-approved for placement in an IRA. You can't open a new IRA through the company but you can roll over funds from an existing 401K plan or IRA and qualify for the benefits of investing in a traditional retirement plan. American Hartford Gold's IRA-eligible product catalog is comprised mainly of coins, but the company also offers a few gold and silver bar products for investors who prefer them.

American Hartford Gold also sells gold and silver coins that are not IRA-eligible, but suitable for other investors. These products don't offer the tax advantages of holding approved coins in an IRA, but may be a good investment for pneumistmatists who enjoy collecting and active trading. Gold and silver coins purchased through American Hartford Gold may increase in value over time. The gain is most often based on the weight of the coins themselves and rising market prices for precious metals—not because the coins are particularly rare or beautiful. American Hartford Gold is not a rare coins dealer, per se. However, the company does offer coins from around the world, which may be of special interest to some investors.

How Much Do Gold and Silver Cost When Purchased Though American Hartford Gold?

While American Hartford Gold does publish a comprehensive product catalog, unfortunately, it does not include prices. That makes it difficult to comparison shop among precious metal sites. To be fair, since gold and silver prices tend to fluctuate daily, it would be a chore for the company to keep prices continually updated. In order to get up-to-the-minute pricing on American Hartford Gold's products, customers can speak with one of the company's specialists. But some customers would rather avoid that step and find that important information on their own.

Currently, the company is offering several promotions, including free insured shipping and up to $10,000 of free silver on qualifying purchases. The company offers first year IRA fees waived for purchases over 50k, and three years of IRA fees waived for purchases over 100k. AHG will typically cover storage fees for your first year and, in some cases, up to three years, depending on the account size. However, you can open an IRA through American Hartford Gold with $10,000. The minimum for cash purchases is $5,000.

Setting Up Your Gold IRA

American Hartford Gold offers a simple and speedy process for setting up your rollover IRA. If you call the company and speak with a product specialist, you can request an application form be sent to you via email. You'll use DocuSign, a digital signature app, to provide your signature on the application and speed the process along. Once you have completed the application, the company will schedule a liquidation call with you. At that point, American Hartford Gold will initiate the transfer of funds from your existing 401K or IRA. The specialist we spoke to reported that it typically takes between 7 and 10 days for the funds to arrive in your new precious metals IRA.

Low Minimum Investment and Fees

You can open a precious metals IRA through American Gold Hartford with only the amount it takes to buy a single IRS-approved coin or bar from the company. That opens the door to many investors who might not be able to participate in precious metals investing—especially those who may only want to dip their toes in the water and not dive fully into precious metals investing. However, if you invest $50,000 or more in your IRA, you'll receive free storage of your metals in an IRS-approved depository. To be clear, all precious metals held in an IRA must be stored in such a facility. These facilities offer additional security, as well. Those who invest less than $50,000 will pay storage fees that are based on value of the precious metals you hold.

The Bottom Line

American Hartford Gold is a good choice for investors who want to diversify the funds they already have in approved retirement accounts using rollover provisions set by law. The company treats customers courteously and fairly, as witnessed by its online reputation and the many consumer reviews that point to American Hartford Gold's knowledgable, patient customer service team.

Reputation

We searched high and low and we couldn't find any consumer reviews of Blackstone Commodity Group nor the company that operates its website, Lennox and Main. The companies don't appear in the Better Business Bureau companies list and they are not reviewed on Trustpilot. Neither has a LinkedIn company page. That's pretty unusual and does make us a little bit wary. No matter how much you're investing, choosing a reputable company with a track record of delivering for its customers is very important. In Blackstone Commodity's case, we could not assess its reputation. The company does have a Facebook page, where the newest post is from 2018.

Flexibility

Blackstone Commodity Group offers gold IRAs. We couldn't learn much else directly from its website, however, it appears that the company works with one IRA custodian who stores customers' precious metals in secured IRS-approved facilities. Assets are protected by insurance from Lloyd's of London. It's unclear whether Blackstone offers metals other than gold or what form the metals take (coins or bullion). It's also not possible to open an account or purchase precious metals directly from the company's website. All communications go through their customer service representatives. Some customers may prefer the ease and speed of an online account-opening process.

Screenshot from Blackstonecommodity.com 3/12/2021

Fees, Promotional Offers and Transparency

Blackstone Commodity Group does not provide any information on its website about gold prices or the fees associated with open a gold IRA through the company. That makes it tough for consumers to compare the company's services to those of other precious metal IRA companies.

Customer Service and Education Resources

You can contact Blackstone Commodity Group by phone or online form. Like most precious metal sites, Blackstone Commodity offers a free investor's guide to precious metals. However, it's not a direct download from the company's website. We expected to be able to download the guide once we provided our contact information but were told, rather, that a company representative would be calling us. Blackstone does publish a blog, but its contents are pretty far afield from the subject of gold IRAs. we did find one article on the advantages of investing in precious metals, but other blog post titles included 6 Tips to Get in the Holiday Spirit and Lean Red Meat Recipes for Your Health. Needless to say, we were a little puzzled.

Founded in 2012, Augusta Precious Metals is an online gold IRA provider. The company offers Americans seeking to diversify their retirement savings an opportunity to open a new precious metals IRA and/or roll over existing retirement savings into a precious metals IRA with confidence. The company focuses on delivering a streamlined and transparent purchasing process that helps investors customize their portfolios and diversify their retirement savings.

The company succeeds in making owning precious metals in an IRA very easy. When you contact the company, you're assigned a dedicated sales agent who walks you through the account opening and portfolio-building process. This representative will prepare much of the paperwork required to open a precious metals IRA for you. That's a great feature for customers who are unfamiliar with self-managed IRAs and the precious metals market.

Augusta Precious Metals maintains a helpful education department, through which it provides economic and product information to help retirement savers make informed decisionsThe company provides free support and education for as long as you have a precious metals account with them.

REPUTATION

Augusta Precious Metals is an accredited business with the Better Business Bureau, holding an A+ rating with 0 customer complaints. The company has no reviews on Trustpilot, but earns 5 stars from TrustLink. Your IRA deposits are insured by a LLoyd's of London all-risk policy up to a maximum of $1 billion. Augusta Precious Metals earns The Business Consumer Alliance awards highest (AAA) rating. If you research the company, you'll see that it has many favorable reviews from investment- and retiremen-oriented news sources.

FLEXIBILITY

Customers can purchase a gold or silver IRA through Augusta Precious Metals. The process is straightforward, with representatives guiding the customer through the required forms to open an account and fund the IRAs.

The first step is contacting an Augusta customer agent, either directly by phone or by filling out an online form to have one of them call you. The agent will act as your liaison and book an appointment with a representative from the company’s education department. During this meeting, customers learn about the current economic climate, how the gold and silver markets are doing, and how your investment or retirement needs fit into it.

The next step involves the IRA processing team, which helps in the application and funding of the IRA, including transfers and rollovers from existing retirement accounts. After that, the customer decides which products they wish to purchase and safely transfers them to the storage facility.

At any time during the process, Augusta representatives are available to answer any questions and help you build a well-designed precious metals portfolio.

In addition to facilitating retirement investing, Augusta Precious Metals can sell you gold and silver coins and bullion for self-storage outside of an IRA. These purchases do not come with the same tax advantages that saving in an IRA does, but may be of interest to some customers.

FEES, PROMOTIONAL OFFERS AND TRANSPARENCY

Augusta Precious metals he website does not offer details on product prices because the cost of precious metals varies from day to day with the market. Current prices are confirmed and recorded when you speak with one of Augusta’s representatives.

CUSTOMER SERVICE AND EDUCATION RESOURCES

The company website features the latest market news so customers can keep up with what’s happening in the finance world and get a better understanding of the context of their investments. The resource center has plentiful FAQs, videos, and charts that can provide valuable information to the customer. Theyoffer a highly-informative one-on-one web conference that covers the gold IRA process including fees; the economy, inflation and reasons to buy gold; and ways consumers can avoid falling for other gold companies' scams, gimmicks & high-pressure tactics, such as the “excessive silver scheme.” They also offer resources such as “10 Big Gold Dealer Lies” and “15 Bad Reasons to Buy Gold.” Furthermore, customers can request a free kit that serves as a guide to precious metal investing and gold IRAs.

Customers can contact customer service via email or by phone, available from 6:00 a.m. to 5:00 p.m. (PT). The Augusta Precious Metals website also offers live chat.

Preserve Gold is a company specializing in precious metal IRAs and the selling of gold, silver, platinum, and palladium products, including coins and bars. The company offers both new and roll-over IRA account options that are approved by the IRS, as well as precious metal purchases for home storage. The company is based out of Woodland Hills, California and was founded in 2022.

Preserve Gold provides precious metals for a number of Individual Retirement Accounts (IRAs), including:

- Traditional IRA

- Roth IRA

- Traditional 401(k)

- Roth 401(k)

- Thrift Savings Plan (TSP)

- 403(b)

- 457(b)

- Simplified Employee Pension (SEP)

- Savings Incentive Match Plan for Employees of Small Employers (SIMPLE)

- Tax-Sheltered Annuity (TSA)

The company includes a wide range of educational content on the benefits of including precious metals in your IRA portfolio. The company also offers an RMD (Required Minimum Distribution) calculator that shows you how much you will need to withdraw from your IRA once you retire to be in compliance with IRS regulations.

You can contact Preserve Gold through the phone at (866) 579-5390 to speak with a precious metals specialist. You can also schedule an appointment and have the company call you at the time of your choosing. The company promises a no-pressure sales strategy with transparent and competitive pricing. Existing clients receive zero liquidation fees at the time of buyback and the company provides lifetime account support from dedicated precious metals specialists.

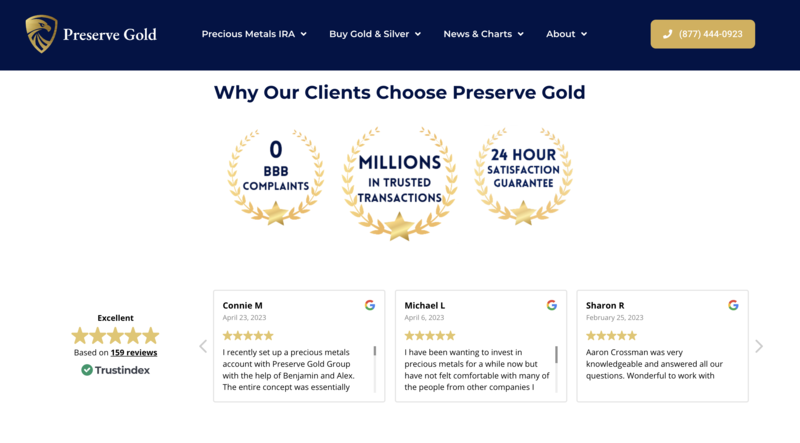

The family-owned company is an accredited business by the Better Business Bureau and has a rare history of 0 complaints. They rank 4.96 out of 5 stars from consumers who rate it on the BBB website. Preserve Gold also earns hundreds of 5-star reviews across Google, Trustpilot, and other consumer rating websites.

All in all, Preserve Gold provides all the services you would expect from precious metals specialists and then some. By consumer accounts, the company offers great customer service, with patient advisors and transparency throughout the sales process. The company goes the extra mile by providing a great deal of educational content and need-to-know information on the constantly changing world of precious metals and IRA investing. Preserve Gold is a solid choice for people who wish to diversify their retirement portfolios by investing in precious metals.

More insight into our methodology

In order to find the best Gold IRAs, we looked at factors such as a company's reputation among customers and third parties, flexibility options, fees and promotional offers, and the overall quality of the provider's customer service.

Reputation

Whether you invest in stocks, bonds, real estate, or pork belly futures, all investments involve risk. Precious metals are no different. If you’re considering investing in them, choosing a reputable company to sell you precious metals and look after your investment is paramount. We looked to consumer ratings to check the reputations of all companies we reviewed to ensure all of them receive high marks for customer satisfaction and reliability.

Flexibility

There are a number of ways you can invest in precious metals, from purchasing and holding physical precious metals yourself to opening a self-directed IRA to hold your precious metal assets with the advantage of tax savings. We favored firms that give you multiple options on how to hold and manage your investment. We also noted which companies offered multiple metal choices for your investment.

Fees, Promotional Offers & Transparency

Like banks and investment firms, some precious metal companies charge fees for opening an account and maintaining your account as well as for individual transactions. We compared these fees to see which companies had the most favorable fee structures. Too many fees can cut into the investment gains you might make should the value of the metals you purchased increase. Knowing up front what fees you will be charged is important before investing through any firm. We researched how well companies explained their fee structures and purchase agreements online, too.

Customer Service & Resources

If you’re new to precious metal investing, you’re likely to have a lot of questions. Companies that offered access to comprehensive educational materials on their websites rated highly with us. We also compared how easy each company makes it to reach their customer service representatives.

Helpful information about Gold IRAs

Precious metal IRAs, sometimes known as Gold IRAs, are a type of individual retirement account in which precious metals are held in custody for the IRA account owner instead of traditional paper assets. The four precious metals allowed by the IRS are gold, silver, platinum and palladium, but since gold is the most common one bought, all four are usually lumped in under the term “Gold IRA.”

Gold IRAs are a type of self-directed individual retirement account, which allow for alternative investments such as precious metals, real estate or even livestock instead of traditional stocks, bonds or cash. Gold IRAs usually involve a supply chain consisting of an IRA custodian who buys the gold on your behalf, a metals dealer who sells you the precious metals, and a IRS-approved depository in which the metals are stored. These all incur fees that vary and is a cost that must be taken into consideration when looking into Gold IRAs.

Precious metal IRAs can be traditional or Roth IRAs, in which contributions are often tax-deductible and transactions and earnings have no tax impact. Gold IRAs can be beneficial to investors looking to diversify their portfolio, as gold prices usually move in the opposite direction of liquid assets and can be used as a hedge against currency devaluation or inflation.

Although gold prices can go up or down unexpectedly, having gold and paper assets as part as a diverse portfolio could help mitigate disruptions in either market. Since 2016, gold has become increasingly difficult to mine as most miners have to dig deeper to get the same amount of gold, which along with central banks looking to diversify their monetary reserves, help drive the price of it and other precious metals used in IRAs.

Precious metal IRAs are one of the most common alternative investment IRAs, particularly popular in markets that have recently seen instability. Putting a percentage of your individual retirement account in gold is a tried and true method of offsetting risks and diversifying your portfolio, although you should always consult a financial advisor to determine how precious metals can work together with the rest of your portfolio.

FAQs about Gold IRAs

What kind of precious metals can be held in my IRA?

The IRS allows gold, silver, platinum and palladium to be held in self-directed IRAs, although gold is the most common metal held. The metals can be held in IRS-approved bullions or coins and have to meet a specific purity standard.

Can I take physical possession of the gold or precious metals in my IRA?

No. The IRS allows for gold in a self-directed IRA to be handled only by insured depositories, as holding them privately would be considered furnishing a service or facility and would be considered engaging in a prohibitive transaction.

Can I transfer money from an existing IRA or 401(k) account to fund a self-directed IRA?

Yes, and as long as it is being transferred from one tax-advantaged account to another, you will incur no tax penalties for doing so. You can transfer the full sum of your account or a partial amount.